Businesses have ongoing incentives to acquire and install capital equipment. The Tax Cuts and Jobs Act of 2017 made significant changes to both Section 179 and bonus depreciation. These changes continue to be in effect for 2020 and when used together may allow businesses to deduct up to 100% of capital purchases.

Section 179

- Deduction limit increased from $1,000,000 to $1,040,000.

- Phase-out threshold increased from $2,500,000 to $2,590,000.

Speak to a qualified tax professional familiar with your specific business circumstances.

MACHINE LINEUP

|

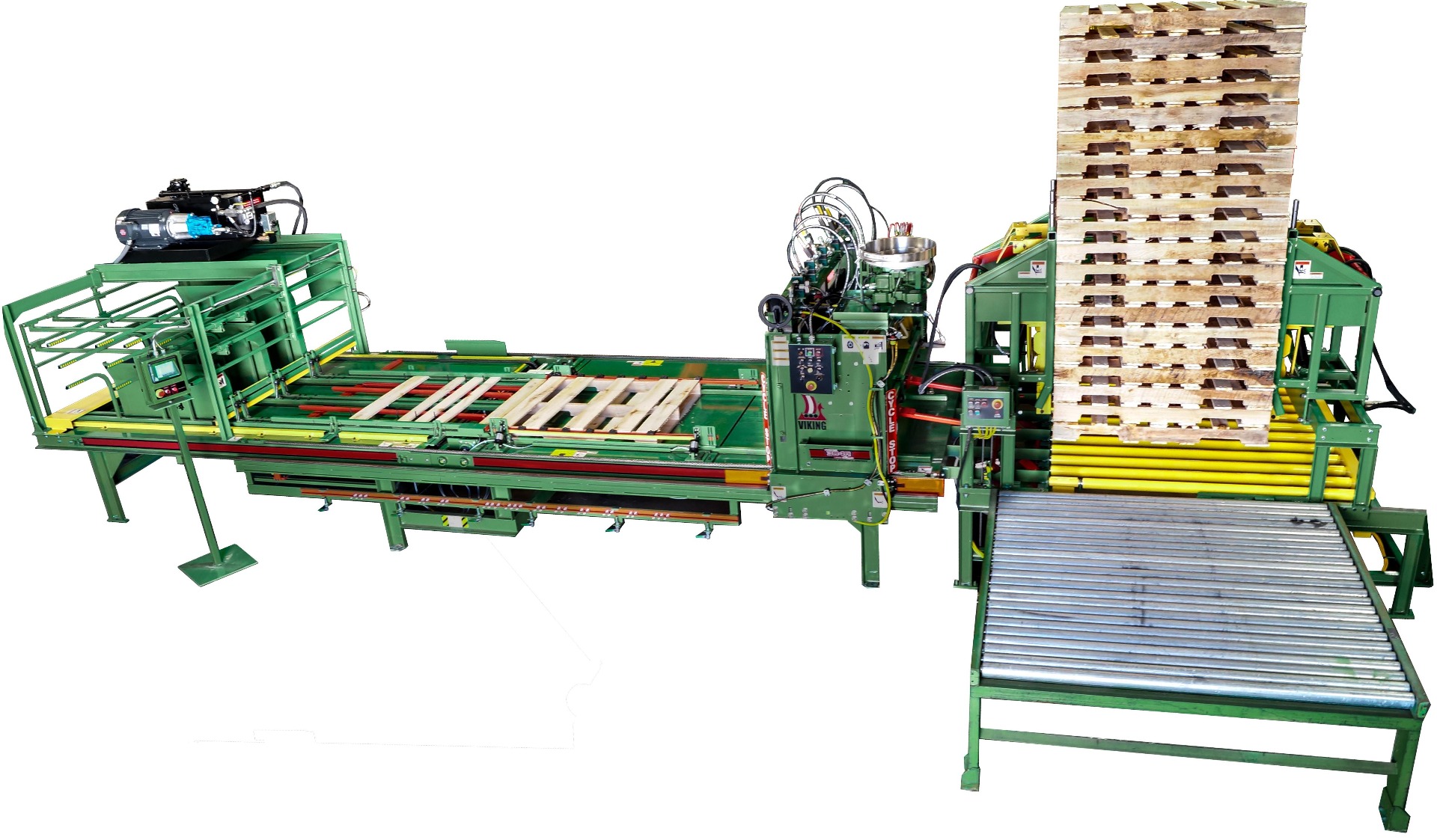

TURBO 606 · 2,000+ Pallets/Shift · Single Nail Bowl · Fast Pallet Changeovers |

|

|

TURBO 505 · 1,800+ Pallets/Shift · Turbo Pro Plus Data Software · Reliability & Ease of Operation

|

|

|

EXPRESS 403 · 2 operator - 1,300+ Pallets/Shift · Side Stringer Feeding · Economic Entry Level Tandem

|

|

|

CHAMPION QC306 · 500-600 Pallets/Shift · QC - "Quick Change" Overs · New/Recycled/Low-Grade Lumber

|

|

|

CHAMPION 304A CLASSIC · 500+ Pallets/Shift · New/Recycled/Low-Grade Lumber · Economic, Singe Operator, Entry Level

|

|

CONTACT YOUR VIKING SALES MANAGER TODAY FOR MORE INFORMATION!

|

North Star & Great Lakes Region Darren Bergstrom Office: 763-586-1224 Cell: 218-324-1594 |

|

Western Rockies & Pacific Region Mark Mitchell Office: 763-586-1229 Cell: 612-231-9306 |

|

South Atlantic & Gulf Region Kenneth Rose Cell: 612-716-6975 |

|

North Eastern Atlantic Region Scott Ellefson Office: 763-586-1261 Cell: 612-860-2372 |